Overview

Accounts Receivable is perhaps one of the most important financial processes in any business. In a world driven by credit, purchase orders, and non-cash transactions it is a primary capability a finance organization needs to manage well to ensure the success of the business. It has been said that in any business “cash flow” is king. For most organizations the cash that flows into the organization is managed through the Accounts Receivable function.

Accounts Receivable is a measure of what the company is owned by its Customers. Managing it well, is de rigueur for a healthy business. Organizations have multiple ways to finance their operations, but approaches such as borrowing either through bond sales, or directly from lenders, selling stock, or equity, in the organization are generally accepted means to either invest in the business, or provide short term funds during down periods of the business. The primary means for businesses to fund ongoing operations is through the direct sale of their products or services to their Customers. Since most business transactions are not conducted using currency or cash, the Accounts Receivable function serves as the means an organization can use to monitor and manage the health of the ongoing business.

Managing the Accounts Receivables effectively is a good measure of the overall sophistication of the organization’s operations and of the quality of its financial practices. Years ago I was involved in the ownership of a small business. It became clear early on that the business was not well run as most of the Accounts Receivables of the organization were 6 to 9 to 12 months overdue. At the time we were trying to sell the business and prospective buyers when examining the business were turned away when they realized we were doing a very poor job in collecting monies that were owed to us. Several commented that they viewed the failure to collect past due Accounts Receivables as a broader sign that the business was probably not well run.

Overview

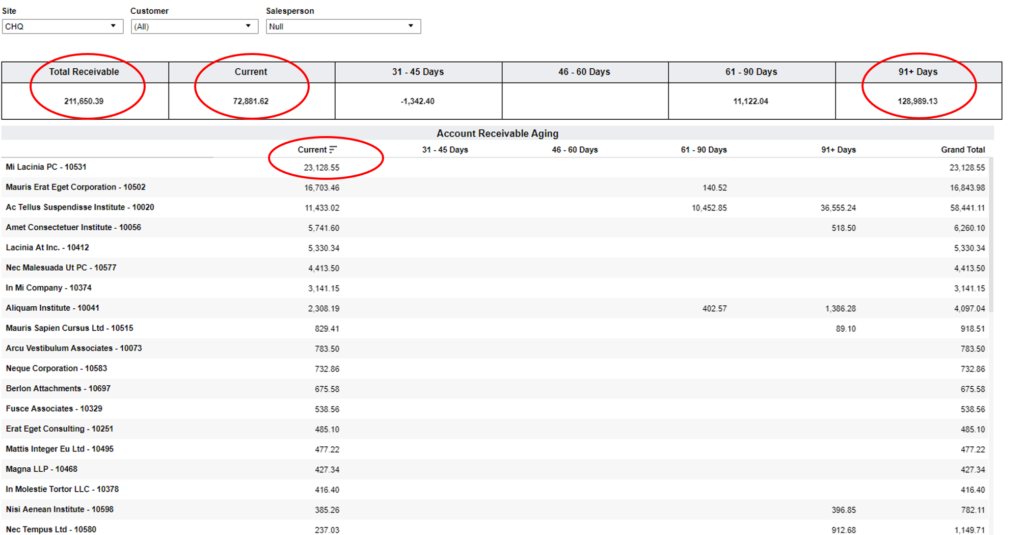

One of the first areas to examine is what is the overall state of the Accounts Receivables. Typically this involves looking at something called an Accounts Receivables Aging Report. In Figure 1 below is an example of such a report. Note that it shows across the top the summary of the data for the total Accounts Receivables and a breakout by different time frames. The Total Receivables and those that are considered Current (i.e. due in 30 days or less) are listed first (see two upper left red ellipses). Then the next time frames are broken out into different time buckets of 15 or 30 day time increments. The final tally is broken out in 91 days and greater. (see upper right red ellipse). The timeframe of 91 days is significant as this represents receivables due from a prior quarter. With many businesses reporting financial results quarterly, this is a red flag that the receivables may be difficult to collect and that they are impacting the reported financial results in a real way. Additionally below the summary data, the Accounts Receivables are listed by each Customer that owes these receivables in a tabular format. This data is also broken out in similar time frames. The tabular format is also sortable from high to low (or vice versa) according to these different time frames. In Figure 1 below the tabular data has been sorted by the first column (Current Accounts Receivables due in 30 days or less). This shows the various companies and what they owe in Current Accounts Receivables from high to low. (see lower red ellipse). NOTE: That the tabular data below is sortable by any of the columns shown.

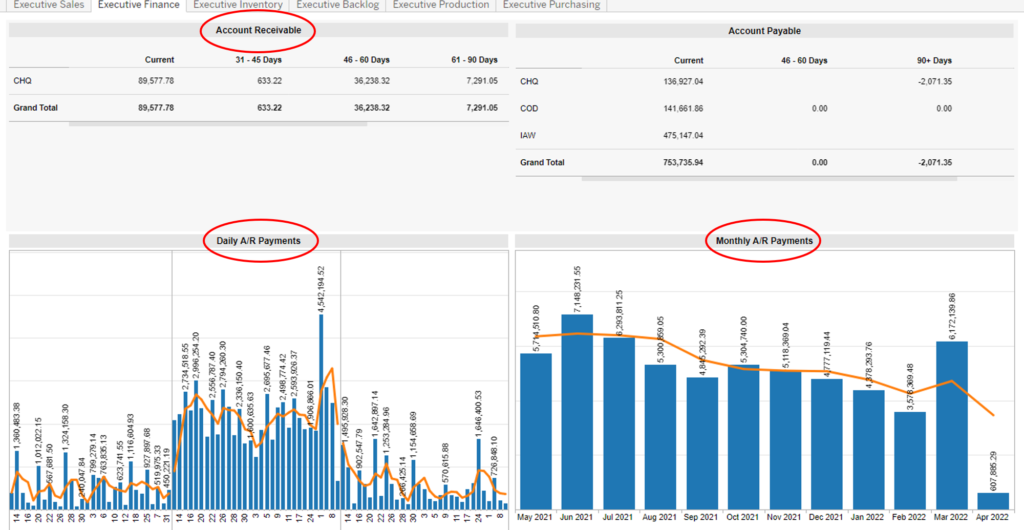

Another perspective that might be appropriate is to look at an Executive report that provides data on Accounts Receivables and how those payments are being received over time. In Figure 2 below we have an Executive Finance report that shows aggregated data for Accounts Receivables and Accounts Payables. At the top is shown the Accounts Receivables summarized over different time frames (see upper left red ellipse). Then below that the Accounts Receivables data is presented based on daily payments (see lower left red ellipse) and monthly payments (see lower right red ellipse). This data can help an Executive see how payments are trending over time, whether there are any patterns to the payments and whether there is any seasonality or other red flags in payment activity that should be noted.

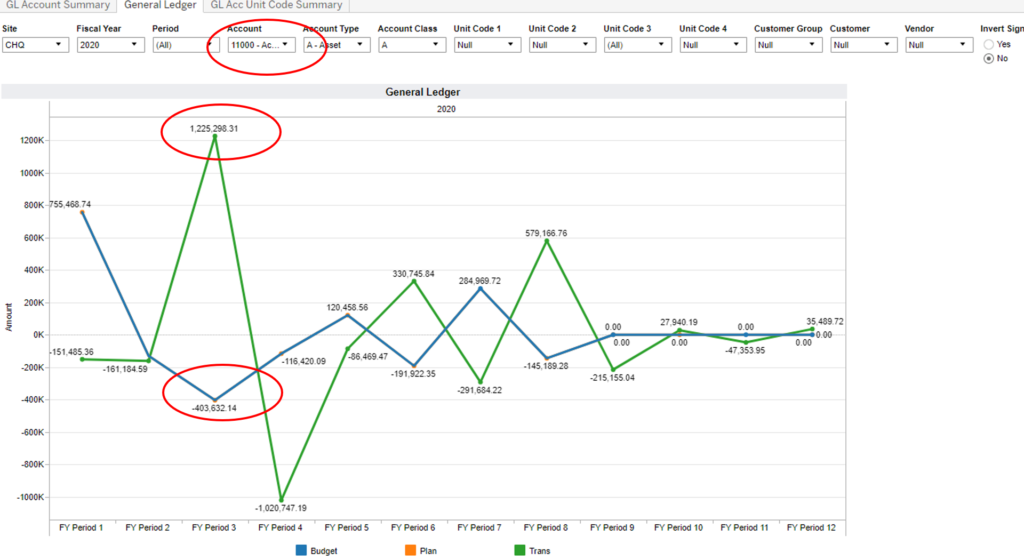

Another perspective of Accounts Receivables is to view it in comparison to what the company had planned for it to be (i.e. the budget). Below in Figure 3 is a view of the General Ledger budget data over time, filtered to just show Accounts Receivable (in this example Account 11000) (see upper red ellipse). The Blue line belows represents the Budget for Accounts Receivable and the Green line represents the actual Accounts Receivable transactions for a given period. This data has been broken out by Accounting Period which are essentially months. The dashboard below can provide insights as to whether revenue or expenses are adhering to the plans. In the example below there is a wide discrepancy in the Accounts Receivable actuals versus the Budget for the 3rd period (see two lower red ellipses). This may require further investigation by finance to understand why there is such a large discrepancy for that particular period.

Detail Look at Accounts Receivables

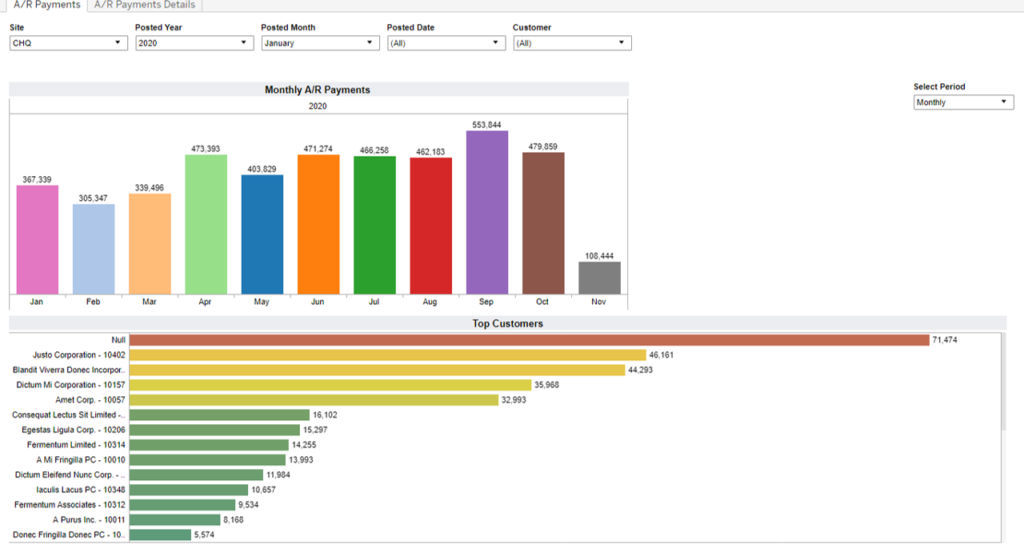

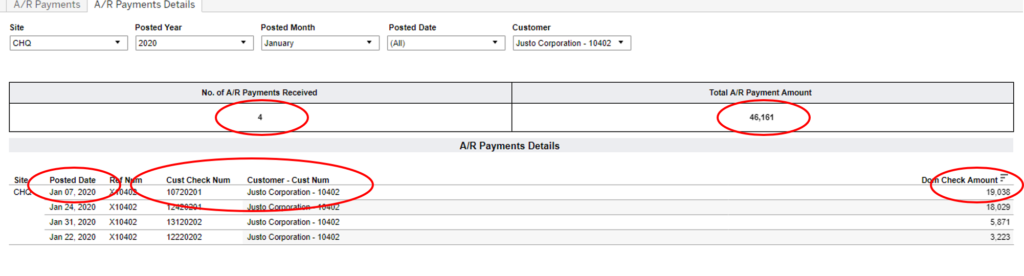

In a number of circumstances a Finance Executive may want to look into specific detail regarding the situation with Accounts Receivables. In these circumstances they may want to explore activity in Accounts Receivables for a specific month or in regards to a specific Customer. In Figure 4 below we have a report that shows the Accounts Receivable payments received for a specific month in this case the month January of 2020 (see upper two red ellipses). Below in chart form we can see the various Customers who had made Accounts Receivable Payments for this time frame (see lower red ellipse). If we are interested in the Payment activity for one of these specific Customers we select the bar next to the Customer name and click on it. This will enable us to drill down into the specific detail for that Customer for that month (in this example we are looking at the Customer Justo Corporation for the month of January 2020). This will then take us to the A/R Payments Details Report that is displayed below in Figure 5.

Below in Figure 5 we can see the details for the Customer Justo Corporation. In the month of January 2020 they made 4 payments totaling $46,161 (see two upper red ellipses). The specific Payment Date is illustrated (see leftmost red ellipse) and the actual Customer Check Number and the Customer Name are also displayed (see lower middle red ellipse). Finally the dollar amount of each specific Check is displayed in the far right column (see lower right red ellipse). This level of detail enables a Finance Executive to have very specific information about the Accounts Receivable history for a specific Customer and empowers them with the ability to know at a fine level of detail what is occurring with the Payment history of their Customers.

Accounts Receivables Customer Payments Views

For any organization it can be very important to understand how their actual Customers are making payments. As has been said, the “devil is in the details” and having a detailed look at how specific customers are paying, how timely their payments are, whether they are paying on-time or late can be valuable in better managing specific terms and conditions across the customer base.

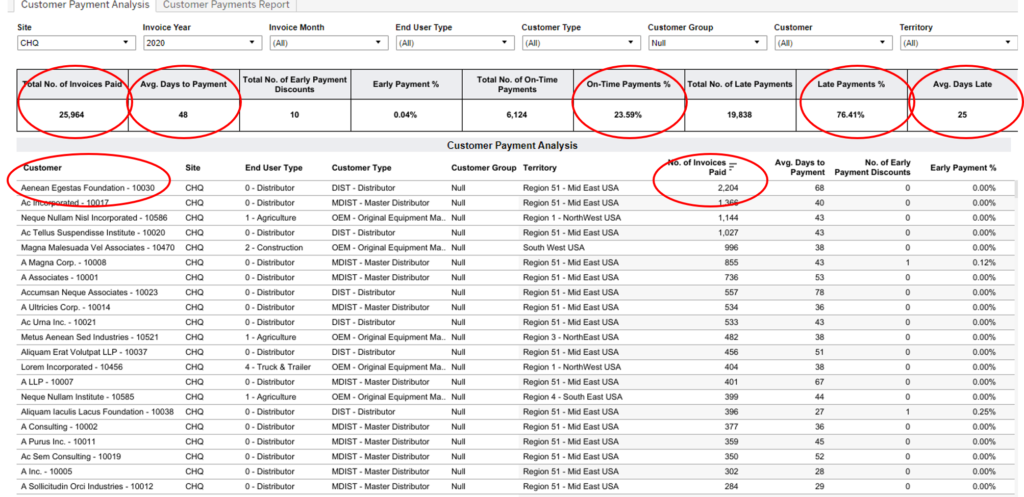

Using a dashboard called the Customer Payment Analysis we can look at some detail on how our Customers are paying us. Below in Figure 6 is an example of this dashboard. In the upper table we can see important data about Customer Accounts Receivable payment history. Across this table from left to right we can Total No. of Invoices Paid (NOTE: Data is for Fiscal Year 2020)., Avg. Days to Payment, On-Time Payment %, Late Payment %, and Avg. Days Late. (see upper 5 red ellipses). This data is a quick snapshot of how our Customers are paying their Invoices. Clearly at 76.4% Late Payments there are issues we will need to address. Below the summary data are specific details organized by the Customer. This data has then been sorted by Customer from the Most Invoices Paid to the least. (see lower right red ellipse). In this example the Customer Aenean Egestas Foundation has the highest number of Invoices Paid (see lower left red ellipse).

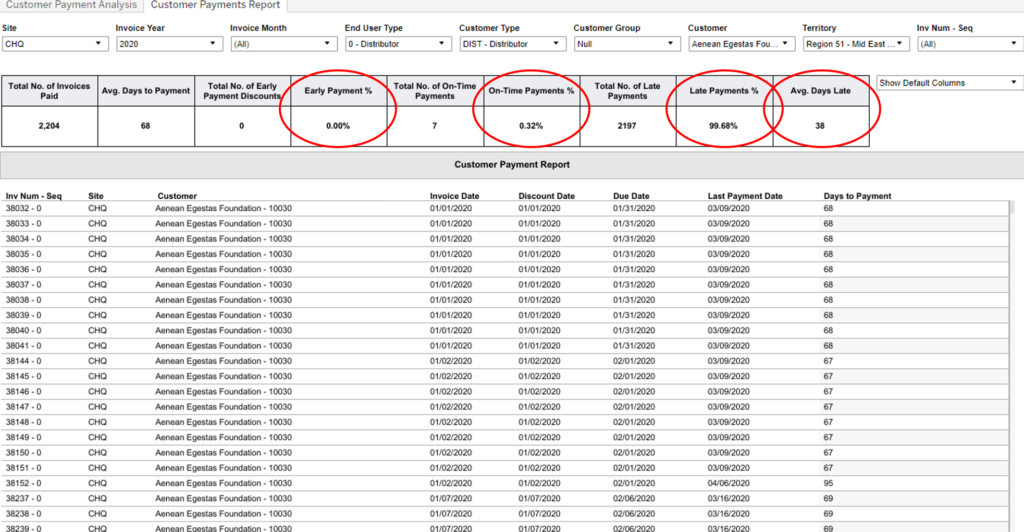

If we then filter this data using the filter setting under Customer to this particular Customer (Aenean Egestas Foundation) then select the Customer Payments Report tab, we get the view seen below in Figure 7. In this Report we can see the overall Payment data for this Customer and the specific detail in the table below. The table below has been sorted from high to low values of Days to Payment. Looking at the data in upper table we can see the Early Payment % (which is zero), the On-Time Payment % (less than 1%), the Late Payments % (over 99%), and the Avg Days Late (38 days) (see 4 upper red ellipses). With this data we have a clear view of what our Customers are paying, how timely those payments are, and which Customers have the most Invoices and how they are paying those Invoices. From this data we can make decisions as to what programs we may need to implement to ensure more timely payments, or perhaps directly connect with this Customer on the reasons for any Payment delays.

Summary

We have looked at some key metrics in regards to the Accounts Receivable activity in an organization. Managing Accounts Receivable is perhaps the key determinant in driving an organization’s cash flow and their ability to function and stay afloat as a viable business. To do this well there must be the ability to look at the overall state of Accounts Receivables, how these are trending on a Daily and Monthly basis, which Customers are the ones with the most Invoices and what does their Payment history look like against these Invoices?

We first looked at an Accounts Receivables Aging Report to understand the overall Cash Flow stream we are expecting and whether when have Payments due that fall beyond key Monthly and Quarterly time periods. We also looked at a Finance Executive Summary Report that gave us details of Accounts Receivables Payment from a Daily and Monthly perspective. We also examined a dashboard that showed what our Budgeted Accounts Receivables Payments were expected to be on a Monthly basis. We also illustrated how we could examine Monthly Account Receivable Payments by Customer and drill into that detail to see the actual Invoices, Payment Date, Check Number and Payment Amount. Lastly we looked into a Customer Payment Analysis dashboard that let us look at each Customer’s Payment history and whether they were paying Early, On-Time, or Late and what are the details behind this Payment history.

As in any aspect of managing a business, Accounts Receivables present a number of key challenges. For many companies how well they manage Accounts Receivables can often determine the success of their business. A company that cannot collect what it is owed from its Customers and do so in a timely fashion, will not be in business for very long.We have illustrated some capabilities in this Blog of how our technology can assist in the process of managing Accounts Receivables. Reach out to us today and we can explore these capabilities in more detail with you.